Best CRM Software for Financial Advisors

In a Nutshell

As a fund manager, I’m at the helm of a very complex and important business. My success depends on my ability to manage all aspects of my firm, from client relationships to compliance, customer service, reporting, analytics, and beyond.

I use a CRM to help me manage these areas. It helps me stay on top of my game and make sure all my bases are covered. And it’s not just for the big guys; CRMs are also great tools for smaller businesses to use.

Having said that, let me cut to the chase and talk about the 5 best CRMs for financial advisors in 2023. Just to let you know, I looked at key features, integrations, and more. I also took a look at what other financial advisors were saying about the systems they use.

5 Best CRM Software for Financial Advisors

After thorough testing and evaluation, I’ve discovered the following tools as the best call center CRM software:

- Salesforce- Best for larger companies

- Wealthbox CRM – Best CRM specialized for Financial Advisors

- Redtail CRM – Best for streamlining practices

- Junxure CRM – Best for improving operations

- Practifi – Best for pipeline management

top 5 CRM Solutions for Financial Advisors

A friend recommended this CRM software to me, and I’m not one to take recommendations lightly. So I looked into how powerful it was and realized that this could be a game changer for my business.

So I decided to give it a try, and I’m glad that I did. It’s a solid CRM system with a lot of tools and features. But the real selling point for me is its Financial Services Cloud feature, which allows me to create in-depth client profiles and consolidate personal information, financial data, goals, and preferences in a single view.

This allows me to better understand my clients’ needs, which allows me to provide personalized advice and services.

In addition, it automates various tasks, such as data entry, appointment scheduling, and reminders, which allows you to focus on more strategic and value-added activities. This increased efficiency and productivity can help build a better advisory practice.

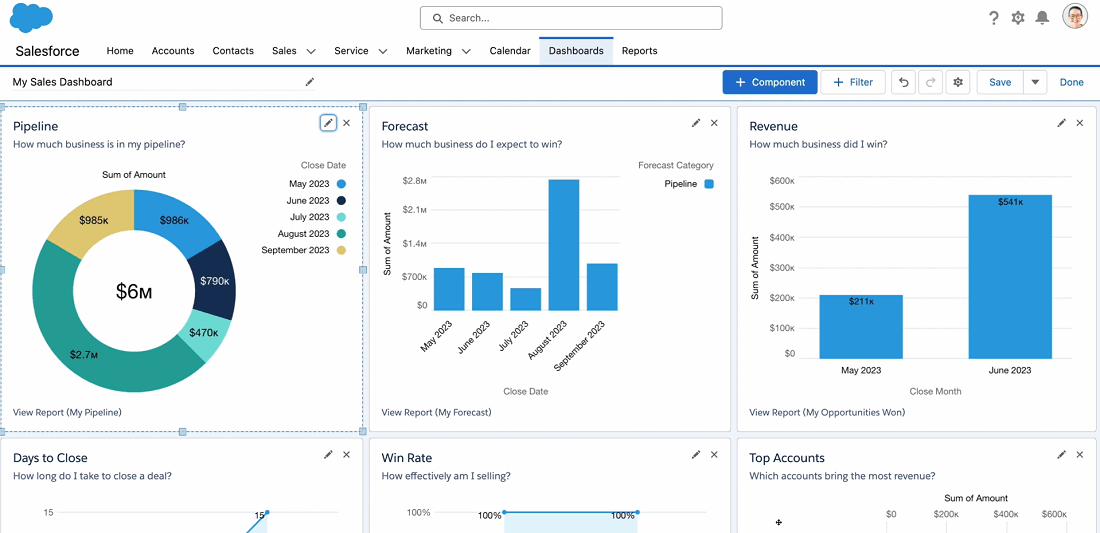

The CRM also offers robust reporting and analytics capabilities, which help you track your performance, identify trends, and make data-driven decisions to enhance your services.

Furthermore, Salesforce CRM’s integrations with various financial tools and platforms allow for seamless data exchange and a more streamlined workflow. This integration makes it easier to access relevant information and collaborate with other professionals, such as accountants or legal advisors, to offer comprehensive financial solutions.

Pros

- Increased efficiency

- Improved customer data management

- Streamlined workflows

- Enhanced collaboration and communication

- Better customer engagement and retention

Cons

- High cost

- Steep learning curve

- Customization requires technical expertise

If you’re looking for a CRM designed specifically for financial advisors, then I recommend Wealthbox CRM.

It’s a cloud-based wealth management CRM solution that helps financial advisors, accountants, and other financial professionals manage their clients.

The CRM software comes with a set of preconfigured workflows to help users track leads, manage prospects, organize client data, and more. It’s designed to be easy to use, allowing you to create new leads and manage existing ones with just a few clicks.

It includes features like contact management, email tracking, task management, workflow automation, and calendar integration.

What’s great about this CRM, in my opinion, is that it allows you to integrate with popular portfolio management software like Orion and Black Diamond, allowing you to easily track client investments and monitor their performance over time. This is incredibly helpful in providing personalized advice and recommendations to your clients if you ask me.

In addition, Wealthbox CRM integrates with financial planning tools like eMoney and MoneyGuidePro, allowing financial planners to create customized financial plans for their clients and track their progress over time. This is an essential resource for helping your clients achieve their long-term financial goals.

Pros

- User-friendly interface

- Robust reporting and analytics

- Integrates with other financial software

- Advanced security features

Cons

- May not be suitable for larger institutions

- Relatively high cost

Redtail CRM is an invaluable tool that I highly recommend for financial advisors seeking to streamline their practice and enhance client relationships.

This powerful customer relationship management system offers a comprehensive suite of features tailored specifically for the financial services industry. With Redtail CRM, you can effectively manage your contacts, track client interactions, and organize your day-to-day activities in a user-friendly interface.

The platform’s robust automation capabilities enable you to save time and focus on providing personalized service to your clients. Additionally, the seamless integration with popular financial planning and portfolio management software ensures that you have a 360-degree view of your clients’ financial situation.

Also, Redtail’s commitment to security and regulatory compliance further solidifies its position as a top choice for financial professionals.

Pros

- Industry-specific features tailored for financial advisors

- User-friendly interface and easy-to-use dashboard

- Comprehensive contact and client management

- Strong security and regulatory compliance measures

Cons

- Not suitable for non-financial industries

- Pricing might be a concern for smaller practices or solo advisors.

Junxure Cloud CRM is a fantastic solution for financial advisors for several reasons, including its ability to improve efficiency, enhance client relationships, and provide valuable insights.

Based on the information I’ve seen from other financial advisors, it seems that Junxure Cloud CRM is a popular choice for many.

The platform streamlines the daily workflow of financial advisors by centralizing client information, communication history, and important documents. This allows you to easily access and manage their clients’ data, ultimately leading to improved productivity and time management.

It can also help you cultivate strong client relationships since it provides a good range of client engagement tools. It allows for easy scheduling and tracking of meetings, tasks, and reminders, ensuring that no client communication falls through the cracks.

You might also want to know that like many other CRMs, Junxure Cloud integrates with leading portfolio management tools, such as Orion Advisor Services, Morningstar Office, and Black Diamond, which allows you to access and analyze client investment data within the CRM itself.

I also appreciate the compatibility with financial planning applications like eMoney Advisor and MoneyGuidePro, as they enable you to create and monitor comprehensive financial plans while ensuring data consistency across platforms.

Junxure Cloud CRM also connects with major custodian and brokerage platforms like Fidelity Wealthscape and TD Ameritrade Institutional, making account management and the account-opening process much smoother.

The platform’s integration with document management systems, such as Laserfiche, Box, and ShareFile, helps to securely store, manage, and share client documents directly through the CRM.

Pros

- Tailored industry-specific features designed for financial advisors

- Time-saving automation and customizable workflows

- Seamless integrations with leading financial software

- Enhanced client communication and secure document sharing

Cons

- Potentially steep learning curve for less tech-savvy users

- Subscription pricing may be less affordable for smaller firms

- Limited customization options compared to some competitors

As a financial advisor, I have always been on the lookout for tools that can help me better serve my clients and manage my practice efficiently.

Recently, I came across Practifi CRM, and after visiting their website, I found that Practifi offers a comprehensive solution that caters to the unique needs of financial advisors.

With Practifi, you don’t have to juggle multiple systems or manually input data, as Practifi seamlessly integrates with other software solutions.

This includes portfolio management and financial planning, such as Black Diamond and MorningGuidePro. It also offers many of the tools and key features you find in a full-fledged CRM system, such as sales pipeline management, lead management, document management, contact management, marketing automation, data analytics, and more.

Pros

- Comprehensive set of features

- User-friendly interface

- Powerful integrations

- Robust reporting capabilities

Cons

- Expensive pricing

- Steep learning curve for some features

Final Thoughts

After carefully examining numerous CRM options available in 2023, I firmly believe that the best CRM for financial advisors is the one that effectively meets their unique needs and integrates seamlessly with their workflow.

For me, the top contenders in this space include Salesforce Financial Services Cloud and Wealthbox. Each of these platforms offers an array of features tailored specifically for financial advisors, such as client management, automation, and regulatory compliance tools.

Personally, I am most impressed by Salesforce due to its user-friendly interface, robust set of features, and excellent customer support. It has proven to be a game-changer for financial advisors, enabling them to focus on client relationships and grow their businesses more efficiently. However, I also acknowledge that Wealthbox, Redtail, Practifi, and Junxure Cloud offer compelling advantages for specific use cases and advisor preferences.

Ultimately, the choice of the best CRM for financial advisors comes down to individual needs, budget, and integration requirements. By taking these factors into consideration, I am confident that financial advisors can find the perfect CRM solution to elevate their practice to new heights.