Best CRM Software for Investor Relations

CRM Investor Relations In a Nutshell

Investor relations management software is essential for businesses managing investor communications and relationships. These tools range from organizing newsletters to targeting new investors. Effective management of these relationships is vital for company growth, and specialized CRM solutions offer evolving features to meet these demands in 2024.

As an investor relations manager, I’ve thoroughly explored and assessed the leading CRM platforms explicitly designed for investor relations. This review aims to identify the top solutions that effectively support the management and improvement of investor engagements.

7 Best CRM Software for Investor Relations Shortlist

- Irwin – Best for investor relations automation

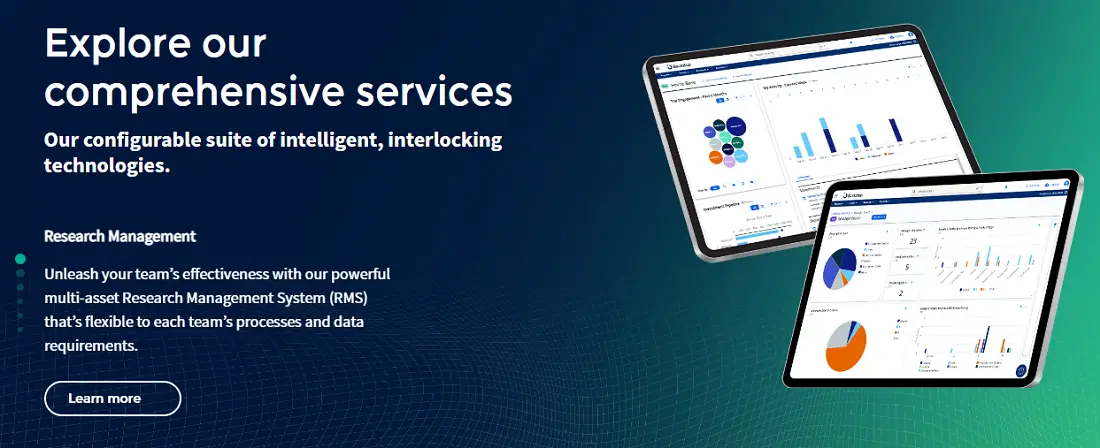

- Backstop Solutions Suite – Best for institutional investment management

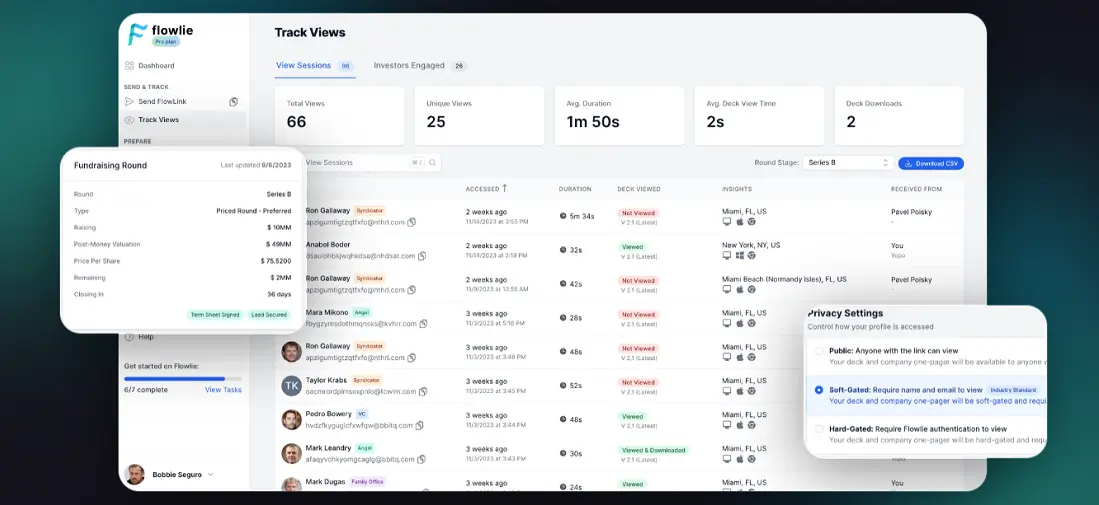

- Flowlie – Best for organizing fundraising for startups for investor engagement

- Captec CRM – Best for increasing communication in asset management

- Nasdaq IR Insight – Best for data-driven investor relations management

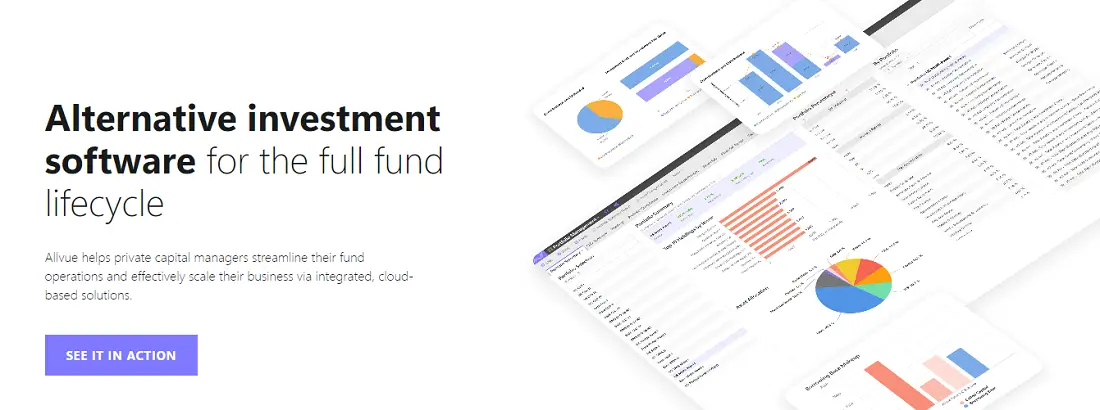

- Allvue – Best for comprehensive investment management across asset classes

- Q4 Desktop – Best for integrated investor relationship management

Why You Need CRM Software for Investor Relations

CRM software is indispensable in investor relations, serving as a centralized hub that enhances strategic communications. These systems provide detailed analytics to predict and meet investor needs. It simplifies processes through automation and personalized interactions on a large scale.

By synthesizing information from various channels, CRMs help tailor communications, anticipate investor behaviors, and support strategic decision-making. Thus, they are essential for maintaining proactive and informed relationships with investors.

Top 7 CRM Systems for Investor Relations

Irwin is best for those seeking a modern, synchronized CRM system that automates and refines investor relations management, focusing on proactive insights and service excellence.

Why I Like It

I was impressed by Irwin’s combination of modern design and powerful functionality. Automation and integrated data reduce my IR teams’ time spent on regular duties, enabling them to concentrate more on strategic activities. With its commitment to service excellence and intuitive user experience, Irwin guarantees that managing investor relations is efficient and effective.

Most Important Investor Relation Features

- Investor Targeting: Access to a vast database of various investor types and advanced filtering capabilities.

- Shareholder Monitoring: Offers comprehensive monitoring tools that include data on retail and non-reporting shareholders, providing a detailed view of the shareholder base.

- Investor CRM: Manages all investor interactions efficiently, facilitating event management and success reporting.

- IR Website Analytics: Provides actionable data from the IR website, helping to identify potential investors and assess risks.

- Professional Services: Extends the capabilities of the IR team with expert support for targeting and market insights.

Pros

- Renowned for its exceptional service in assisting clients.

- Provides robust tools for identifying and engaging the right investors.

- Includes weekly reports from a dedicated expert to keep you informed and proactive.

Cons

- The pricing may be prohibitive for individual IR consultants operating alone.

- Could benefit from enhanced capabilities in shareholder reporting to provide more detailed insights.

The Backstop Solutions Suite is ideal for investment management firms that require comprehensive multifunctional data access and powerful reporting tools to optimize daily operations.

Why I Like It

I appreciate how Backstop simplifies the complexities of institutional investment management. Its intuitive interface, overarching customization options, and secure features make it a breeze. Integrating machine intelligence with human insights, Backstop has empowered me with actionable insights and elegant data management, significantly increasing decision-making processes.

Most Important Investor Relation Features

- Security and Admin Tools: Includes advanced security options like 2FA, SSO, and IP locking alongside strong admin capabilities.

- Backstop IntellX: Streamlines due diligence and document management with automated retrieval processes.

- Custodian Connect and Admin Connect: Automates custodial and fund admin data integration, amplifying data accuracy and accessibility.

- Investor Relations Platform: Offers tools for efficient management of client relationships, from data centralization to performance reporting.

Pros

- The interface is known for its simplicity and ease of navigation.

- Allows for sophisticated report building tailored to daily operational needs through Excel add-ins.

- Supports superb data flows between different management systems and modules within the platform.

Cons

- There’s a lack of flexibility in customizing the user interface.

- Some limitations exist in the integration between contact and account data.

- The vast number of fields can be overwhelming and confusing for users.

- Reporting customization can be cumbersome and time-intensive.

Flowlie is ideal for founders looking to accelerate their fundraising efforts with a technologically advanced, efficient tool for planning, outreach, and investor engagement.

Why I Like It

I’ve found Flowlie’s Fundraising Hub incredibly beneficial for managing the complex fundraising process. Its synchronized approach allowed me to plan my fundraising, prepare detailed outreach, and share the pitch materials effectively. This platform offers a clear framework that simplifies sharing crucial company details and strengthening interactions with potential investors.

Most Important Investor Relation Features

- Investor Database: A personalized database that helps discover investors who are likely to add significant value to the business.

- Deck Sharing and Tracking: Optimized sharing features that include instant tracking of investor engagement with pitch materials.

- Data-Informed Decision Making: Offers benchmarks against extensive data from previous raises to help set the correct fundraising terms.

Pros

- It encompasses an influential investor-targeting solution with tools for tapping into an international network of investors.

- Engagement tracking, which determines when and how often investors engage with shared materials, allows for timely and informed follow-ups.

- Its user-friendly inter-phase is simple and easy to use, making it accessible even for those new to fundraising platforms.

Cons

- There were some mobile compatibility issues with the display of pitch decks on mobile devices.

- While the investor network is extensive, an expansion could provide founders with more potential connections.

- Reporting can be cumbersome

- More customization options would increase user experience

Captec: CRM facilitates effective communication and relationship management within the asset management sector.

Why I Like It

Captec: CRM has been a game-changer for me in bridging communication gaps in asset management. Integrating various technologies, especially mobile and Microsoft Outlook, has significantly broadened communication channels, allowing exceptional interactions across different systems. This integration is crucial for maintaining continuous and flexible communication with investors and colleagues.

Most Important Investor Relation Features

- Integrated Communication Tools: It permits system-wide communication and integrates with Outlook and mobile devices to ensure constant connectivity.

- Customization Options: This option offers flexible data fields and workflow adjustments tailored to specific needs, enhancing the user experience and efficiency.

- Roadshow Coordination: Automates and simplifies the organization of roadshows with tools like on-screen maps and event planners.

- Advanced Security and Compliance: Guarantees data integrity and compliance with industry standards through top-tier security measures and comprehensive compliance functions.

Pros

- The CRM’s ability to integrate with various platforms, including mobile devices and Microsoft Outlook, facilitates effective cross-system communication.

- It simplifies complex tasks, such as organizing roadshows and managing mail distributions, with automated processes and easy-to-use features.

Cons

- The distinction between CRM and Portal products must be clarified, as confusion can occur when users decide which solution best suits their needs.

- While the system offers extensive customization options, navigating these can be overwhelming due to the abundance of features and settings.

Nasdaq IR Insight is ideal for IR teams that require a comprehensive platform to navigate dynamic markets, enhance stakeholder engagement, and execute data-informed IR strategies effectively.

Why I Like It

I find Nasdaq IR Insight incredibly beneficial for its ability to rationalize complex IR workflows and effectively engage diverse stakeholders. Integrating real-time market monitoring with deep analytical tools allows you to understand and act swiftly on shareholder activities.

The platform’s user-friendly interface and powerful functionality make it an indispensable tool for aligning our strategies with investor expectations and improving your overall communication.

Most Important Investor Relation Features

- Robust Stakeholder Engagement: Using a comprehensive contact database engages with diverse investor groups, including ESG stakeholders.

- Real-Time Market Monitoring: Monitors global markets and peers with customizable dashboards and alerts.

- Strategic Analysis Tools: These include proprietary analytics and data visualization for deep analysis and strategy validation.

- Executive Reporting: Provides real-time alerting and board-ready reports highlighting IR program successes.

Pros

- Noted for its effective engagement with ESG stakeholders and its vigorous user interface and experience, enhancing interactions.

- Helpful in keeping users informed with the latest news, updates, and activities related to their portfolios.

Cons

- Issues with the accuracy of monitoring global markets and the contact database, potentially impacting data reliability.

- The system’s information resources can be complex and unintuitive to navigate and utilize.

Allvue is tailored to the dynamic needs of professionals in alternative investment sectors like private equity and debt. It’s designed to bridge the gaps between different investment management processes.

Why I Like It

Allvue impresses with its user-friendly interface and extensive suite of features, tailored to accommodate the requirements of organizations large and small. The platform’s cloud-based architecture warrants that I could access necessary tools and information anywhere. Its scalability is crucial for adapting to my organization’s growth, and excellent customer support readily addresses any concerns.

Most Important Investor Relation Features

- Comprehensive CRM: Streamlines the management of investor relationships, enhancing interaction efficiency.

- Advanced Reporting Capabilities: Features robust reporting tools that support critical financial periods, including quarter-end reporting.

- Seamless Microsoft Dynamics Integration: Merges smoothly with Microsoft’s enterprise environment, enhancing both usability and security.

Pros

- The intuitive interface facilitates straightforward navigation and use, making complex tasks manageable.

- Features a broad suite of tools that are adaptable to various organizational requirements.

- Scalable architecture supports organizational growth and increasing complexity in operations.

- Cloud-based deployment enables convenient access from anywhere.

- Backed by a committed customer support team that provides timely assistance.

Cons

- The cost may be prohibitive for smaller enterprises, limiting accessibility.

- Some sophisticated features have a significant learning curve, which could be challenging for some users.

- Less brand recognition than leading competitors might influence initial trust for new users.

- Some users report restricted access to the cloud version, which could limit the total effectiveness of the platform.

Criteria for Selecting the Best CRM for Investor Relations

Having reviewed several CRM systems for managing investor relations, I’ve pinpointed a set of crucial criteria for selecting the right tool to meet your specialized needs. Here are the key aspects I will advise you to consider.

Specialized Features for Investor Relations

The CRM I chose needed to offer features specifically designed for investor relations. During my evaluations, I focus on:

- Shareholder monitoring capabilities

- Tools for managing fundraising efforts

- AI-powered analytics to understand and predict investor behavior

- Communication tools tailored for disseminating critical financial updates and reports

Integration with Existing Systems

Integration capabilities are paramount. CRM must sync effortlessly with the systems you already use, such as QuickBooks for financial management, Outlook for communications, and SharePoint for document management. A CRM that integrates well ensures that your data remains consistent and accessible across all platforms.

Scalability

As companies grow, so does your circle of investors. The CRM you select must efficiently scale to accommodate increasing investor profiles and more complex relationships. Look for systems that allow you to add features such as investor segmentation without a hitch as your needs evolve.

Customization

Every organization has unique processes, and your investor relations are no different. The CRMs I recommend can be customized to fit specific workflows by adjusting the interface to accommodate your quarterly reporting style or modifying data fields to track unique investor metrics.

Security and Compliance

Given the sensitive nature of the information we handle, security and compliance are non-negotiable. The CRMs must comply with stringent data protection regulations, like GDPR, and feature strong security protocols including data encryption and secure access management.

User Experience

Ease of use is critical. I distinguish CRMs with intuitive interfaces that your team can adopt quickly, minimizing downtime and training. You must value systems that offer excellent customer support and resources to help you leverage the platform effectively.

Conclusion

After thoroughly reviewing several CRM systems, I found that these platforms are distinct in their own right for their ability to streamline and enhance investor relations tasks effectively. Each offers unique strengths to suit different organizational needs in 2024.