Best CRM Software for Mortgage Brokers & Loan Officers

In a Nutshell

I painstakingly investigated and assessed the best mortgage broker CRM software geared specifically to our requirements. In 2024, I’ll reveal the most efficient tools for brokers and loan officers to simplify processes, improve customer connections, and increase sales. Join me as I discuss the top CRM solutions, which are all intended to empower mortgage professionals.

Top 10 CRM Software Solutions for Mortgage Brokers & Loan Officers:

- Salesforce: Best for customer focus

- Zoho: Best for automation

- Freshworks: Best for increasing conversion rates

- Pipedrive: Best for small to medium-sized business

- Agile: Best for basic marketing & sales

- HubSpot: Best for scalability

- Shape: Best for versatility

- BNTouch: Best for staying organized

- Aidium: Best for relationship management

- Velocity: Best for time management

I recognize the importance of having the right tools at my disposal. They can simplify operations and effectively establish client relationships. Keeping up with the ever-changing mortgage industry entails using cutting-edge technology tailored to our needs. After hours of reviewing the most modern CRM solutions available, I’m excited to provide my opinion on the best options for mortgage brokers and loan officers in 2024.

Let’s handle the complex web of client relationships, document management, and lead-generation requirements. These systems not only simplify workflow but also increase productivity and customer satisfaction. With this in mind, I conducted a detailed review of the top CRM software.

I spent days evaluating and assessing their functionalities to discover the best fit for my company’s demands. Here, I explain my results, offering my honest assessment of each product. I’ll examine features, usability, and general performance.

Why Mortgage Loan Officers Need CRM Software

Mortgage loan officers serve critical roles in the mortgage and lending business. They manage complex transactions and cultivate client connections to close deals successfully. In this competitive market, mortgage-specific CRM software is critical. It enables loan officers to manage responsibilities more efficiently, communicate better, and remain compliant with industry regulations.

The greatest CRM for mortgage loan officers has tools that help speed up loan application processes and manage customer interactions. It centralizes customer information, allowing loan officers to easily access and deliver a personalized service.

The best loan officer CRM software also automates repetitive operations such as follow-up emails, which saves loan officers’ time. It usually contains compliance modules to assure regulatory conformity, thus reducing errors and risk to the business and its customers.

Operations are more streamlined, client connections are improved, and regulatory compliance is assured. Investing in a great mortgage CRM is critical to success in today’s competitive mortgage sector.

Top 10 CRM Software for Loan Officers and Mortgage Brokers

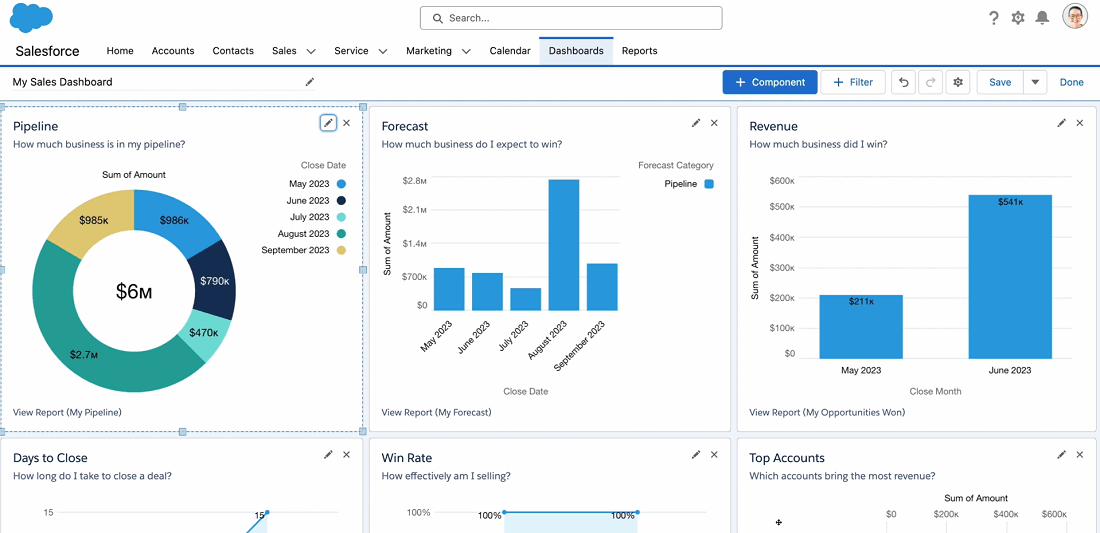

In all my experience delving into numerous CRM platforms, Salesforce emerges as a standout choice. It’s perfect for mortgage brokers and loan officers. Its unparalleled customization options enable me to tailor the CRM precisely, and they cater to the unique requirements of my mortgage business. Optimal efficiency and productivity are assured

Why I Like It

I particularly appreciate Salesforce’s robust lead management and scoring features. This empowers me to effectively prioritize leads and enhance conversion rates. Moreover, its comprehensive reporting tools offer invaluable insights into sales performance, so it boosts informed decision-making for business growth.

Key Mortgage & Loan Broker Features

Extensive Customization

Salesforce’s versatility in customization allows me to adapt the CRM to suit my specific sales pipelines and workflows.

Lead Management & Scoring

The platform offers comprehensive lead management tools. These include sophisticated lead-scoring capabilities. They also enable me to track and prioritize leads effectively, leading to improved conversion rates.

Seamless Integration

Salesforce CRM seamlessly integrates with over 1,000 other platforms, thus streamlining workflow processes and providing access to essential tools and functionalities. These connections are crucial for mortgage professionals.

Document Management

With Salesforce, I can securely store and manage vital loan documents within the CRM to ensure that I remain compliant through efficient document tracking.

Pros

- Extensive customization options

- Robust lead management and scoring capabilities

- Powerful reporting tools

- An easy setup process and a free 30-day trial

- Seamless integration with over 1,000 other platforms

Cons

- Initial setup and customization can be complex and time-consuming

- Requires dedicated maintenance to keep it optimized

- Additional functionalities and add-ons may incur additional costs

I value simplicity and affordability without compromising functionality. Zoho CRM is definitely one of the best free CRM for mortgage loan officers – especially those operating small businesses.

Why I Like It

The availability of a free plan makes it an attractive option for newcomers seeking to streamline lead tracking, and it’s perfect for contact management at an affordable level.

Key Mortgage & Loans Brokers Features

Free Plan

Zoho CRM’s free plan provides essential features including lead generation, contact management, and customization options. This makes it ideal for small businesses and individual users.

Automation

All plans include automation features that allow mortgage professionals to streamline repetitive tasks and workflows.

Seamless Integration

It offers seamless integration with other Zoho tools and third-party apps commonly used by mortgage brokers and loan officers. This improves workflow efficiency and expands functionality.

Mobile App

The availability of a mobile app allows users to access crucial contacts, leads, and deals on the go. This provides greater flexibility, especially for professionals who aren’t always in the office.

Pros

- Free plan option

- Affordable pricing options for paid packages

- All plans include automation features

- Seamless integration with other Zoho tools and third-party apps

- user-friendly

- Mobile app for convenient on-the-go working

Cons

- Limited AI features

- Limited custom fields

- Few integration options in free plan

- Customer support could be better

I’ve spent hours exploring Freshworks’ CRM. It’s been quite a journey, but I value its robust analytics tools, which guide the customer journey extremely effectively.

Why I Like It

Managing email marketing campaigns, lead generation, and deal closure have never been easier. The built-in dialer, chat widget, and social media integrations have kept my client interactions organized and seamless.

Key Mortgage & Loans Brokers Features

Ease of Use

Navigating Freshworks’ user-friendly interface is nice and simple, even for novices to CRM software. I’ve found the extensive online resource library and 24/7 customer support invaluable in my learning journey.

Analytics & Reports

The robust reporting and analytics have provided me with invaluable insights for making informed decisions. Omnichannel communication tools have made client interaction seamless and efficient.

The built-in phone functionality and automation have truly streamlined my sales processes.

Plus, the integration of e-commerce with Shopify and the CPQ module are absolute lifesavers for my online ventures. Tasks are simplified and consistency is maintained like never before.

Onboarding & Implementation

Setting up Freshworks was surprisingly straightforward, thanks to the extensive documentation and online resources available. While implementation time varies based on the chosen plan and customization level, the 24/5 customer support was always there to lend a helping hand.

The Enterprise plan even offers a dedicated account manager for personalized support – a true testament to Freshworks’ commitment to customer satisfaction.

Pros

- Includes AI-powered tools in all paid plans

- Features a basic built-in VoIP phone service with virtual numbers

- Supports global transactions

- Affordability in paid plans

- Indefinite free plan

Cons

- The built-in phone system lacks advanced cloud-based call management features

- Additional charges apply for excess bot sessions

- No volume discount is available for purchasing a large number of seats

- Weekday support only

- Poor customer support

Why I Like It

Pipedrive CRM stands out for its user-friendly design and emphasis on sales pipelines, making it an excellent solution for sales-oriented organizations such as mortgage brokers. While it has plenty of functionality, its simplicity makes it suitable for novices.

Key Mortgage & Loans Brokers Features

Pipeline Management

Pipedrive excels in pipeline management. It enables me to efficiently track leads from initial contact to closure.

Customization

I find the customizable data fields and workflow automations to be perfect for my needs. With them, Pipedrive can fit in with mortgage brokers’ unique needs.

Communication Tracking

Its AI-powered sales assistant and customizable chatbot streamline communication with clients and ensures that no lead falls through the cracks.

Integration

Pipedrive integrates seamlessly with over 400 third-party applications, including mortgage processing software. This integration gives you a huge amount of additional functionality.

Pros

- Unlimited, customizable sales pipelines

- Machine learning-powered sales assistant

- API access for full customization

- Workflow automation

Cons

- No free plan

- Limited custom fields and reports on most plans

- Phone support only available on the highest tier

Why I Like It

Agile CRM impresses me with its broad set of capabilities designed to expedite the marketing, sales, and customer retention operations. Its modern UI and straightforward design make it easy to use, especially for less-experienced CRM users.

Key Mortgage & Loans Brokers Features

Marketing Automation

I appreciate Agile CRM’s drag-and-drop editor. It allows me to automate marketing campaigns effortlessly, saving me time and resources.

Lead Conversion

The ability to convert website visitors directly to leads within the CRM significantly streamlines my lead-generation efforts.

Customer Behavior Monitoring

I find it invaluable to track and score leads automatically based on web or email activity. I’m able to personalize communication and target my marketing efforts more effectively.

Integration

Agile CRM’s extensive integrations are a game-changer for me. I can access customer data from various business apps on one page, enhancing my efficiency and workflow.

Pros

- Ease of Use

- Customer Management

- Customer Support

- Efficiency

Cons

- Steep Learning Curve

- Missing Features

Why I Like it

HubSpot stands out as a comprehensive solution with lots of useful features. The software is perfect for businesses of all types and sizes, and because it’s cloud-based, it’s accessible from anywhere.

Additionally, the robust functionality caters to both B2B and B2C businesses across various industries. HubSpot’s ability to track and nurture leads while analyzing vital business metrics is perfect for me.

Key Mortgage & Loans Brokers Features

Contact Management

HubSpot CRM enables me to manage contacts seamlessly, helping me to ensure that no lead or customer interaction is missed.

Sales Pipeline Tracking

I can identify high-quality leads, automate email marketing, and streamline deal management effectively.

Email Campaigns

HubSpot’s personalized email sequences enable me to engage leads and existing customers. I can take advantage of targeted communication to foster stronger relationships.

Integration

CRM’s integration capabilities include over 500 business apps. These include Google Workspace, Microsoft 365, and Salesforce, so I get flexibility and scalability in managing my workflows.

Pros

- Core CRM software is free

- Real-time lead behavior notification

- Personalized email sequences

Cons

- Per-user plans can become expensive

- Limit of only one email per contact

Why I Like It

Exploring Shape Software has been an enlightening journey for me. It offers a comprehensive suite of tools that help me manage and automate various business operations.

Its modules include cloud-based CRM, Sales Management, and Marketing Automation features. These provide a seamless experience for managing online marketing, capturing leads, organizing sales pipelines, and more.

Key Mortgage & Loans Brokers Features

Sales Force Automation

Shape’s CRM offers robust Salesforce automation features. These include customer data management, workflow management, and interaction tracking.

Marketing Automation

With Shape, I can effectively manage lead generation, lead management, and customer engagement. It also gives me access to automated email campaigns, SMS messaging, and drip automation.

Customizable Dashboard

The customizable dashboard allows me to track department-specific performance, helping me to gain valuable insights into business trends. In turn, it enables me to make informed decisions and optimize my workflows accordingly.

Pros

- Variety of platform integrations

- Accurate data analysis

- Automated notifications. Shape’s automated notifications feature helps me stay informed about critical updates and alerts

Cons

- Automated budget adjustment could be more sophisticated

- Missing Integration with LinkedIn leads

- Not many customizable alerts

Why I Like It

BNTouch stands out as a robust CRM. It offers a plethora of features to streamline operations. Its high-profile customers attest to its credibility and effectiveness. What I appreciate most is its flexibility in pricing plans. It ensures that businesses of all sizes can access its benefits according to their budget.

Key Mortgage & Loans Brokers Features

Lead Management

BNTouch offers a comprehensive lead pipeline and communication tracker which allows me to efficiently manage potential customers and referral partners.

Email & Text Marketing Automation

BNTouch’s sophisticated automation system simplifies targeted messaging, needing minimal human intervention. The centralized email platform and customizable email templates also enhance team collaboration and efficiency.

Marketing Content Library

The extensive library of pre-made marketing content includes newsletters and social media posts. They save me time and effort in crafting engaging campaigns. Additionally, the ability to create and save custom content adds to its versatility.

Pros

- Tailored for the mortgage industry

- Flexible pricing plans

- Streamlined loan application process

Cons

- Not the cheapest option available

- User interface can feel daunting

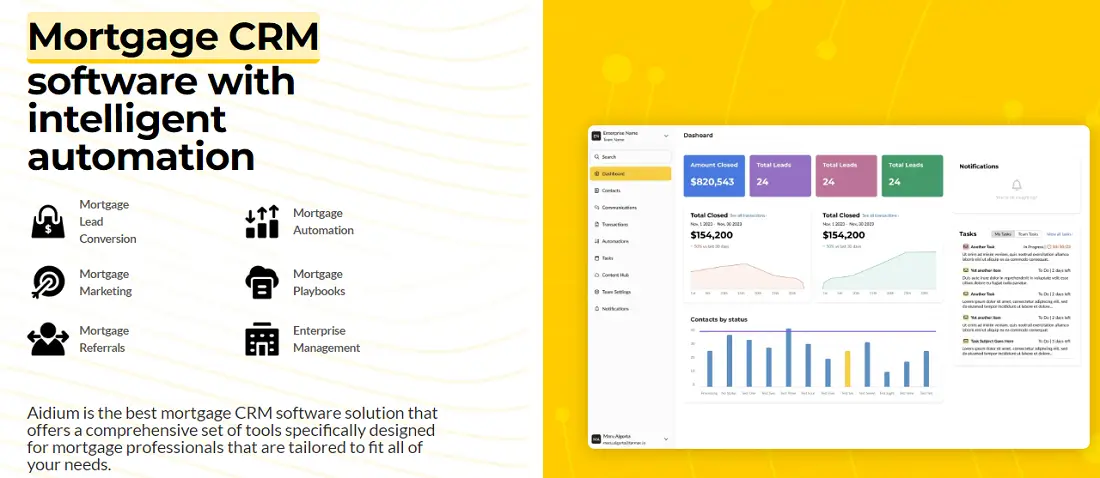

Why I Like It

Aidium prioritizes improving relationships between loan officers, clients, and referral partners. This aligns perfectly with my goals as a mortgage professional. What sets it apart is its scalable nature and accessible pricing plans.

I also appreciate how it unlocks its full range of features across all subscription plans and allows me to leverage its capabilities as my team grows.

Key Mortgage & Loans Brokers Features

Relationship Management Campaigns

Aidium’s campaigns facilitate effective follow-ups with new leads and referrals, ensuring they stay informed and engaged throughout the loan process. Its efficient time management tools keep leads engaged until they progress to the next step.

Lead Pipeline Management

The lead pipeline feature allows for seamless lead management, providing updates on pending actions and facilitating communication with co-borrowers and loan partners. The built-in mortgage pipeline sequences simplify setup, saving time and effort.

Automated Loan Status & Mortgage Event Notifications

Aidium offers automated notifications at every step of the loan process, keeping loan officers and customers informed via emails or texts. The centralized location for communications and email correspondence enhances accessibility and organization.

Pros

- Flexible pricing plans

- Comprehensive lead management and pipeline customization features

- Automated loan status and event notifications

Cons

- Setup process may feel complicated to some users

- Fewer integrations with third-party tools compared to other CRMs

Why I Like It

Velocity stands out as a high quality lead management solution. It caters specifically to mortgage brokers and the needs of the industry. What draws me to Velocity is its unwavering focus on optimizing lead management processes. This makes it an invaluable tool for enhancing sales funnel efficiency in the mortgage sector.

Key Mortgage & Loans Brokers Features

Automated Lead Management

Velocity simplifies lead management with automatic capture, distribution, and prioritization that combine to streamlining the entire process for mortgage professionals.

Robust Integrations

I appreciate Velocity’s solid integrations – particularly the Encompass Connector. It ensures seamless data syncing, enhancing efficiency and accuracy in client management.

Enhanced Lead Interaction

Features like Web to Lead form and click-to-text messaging to boost seamless interaction with leads, fostering engagement and improving communication.

Customizable Email Templates

The inclusion of customizable email templates enables efficient and personalized communication, saving loan officers time and effort.

Rewardification Tools

Velocity implements recertification tools to motivate and engage loan officers, fostering a culture of productivity and achievement within the team.

Actionable Insights

I find Velocity’s AI capabilities and integrated dashboards invaluable, providing actionable insights that aid informed decision-making and performance optimization.

Pros

- Simplifies lead management processes

- Seamless integrations

- Tools to enhance lead interaction and engagement

- Actionable insights through AI and dashboards

Cons

- Occasional UI issues during updates

- Missing some essential

- Limited report customization

- Patchy customer service

- Inconsistent email verification functionality

Key Features for the Best Mortgage Broker CRM

Lead Tracking & Pipeline Management

Effectively manage leads from various channels including social media, referrals, and marketplaces. Look for software that helps you organize leads and track their progress through the sales pipeline.

Automatic Updates

Keep clients informed about their loan status without the need for constant follow-up calls. Choose CRM software that sends automatic updates to borrowers at different stages of the lending process, saving time for both you and your clients.

Mortgage Workflow Automation

You should streamline manual processes and reduce errors. I do this by automating repetitive tasks like application submissions and verifications. Look for software that offers workflow automation to improve efficiency and accuracy in loan offerings.

Paperless Application Portal

Provide clients with a convenient and user-friendly digital application portal. There, they should be able to submit documents, e-sign disclosures, and track their loan status online. A paperless application process enhances the customer experience enormously.

Document Management

Simplify document collection and management by using software that allows you to request and track essential documents from clients. I always look for features that automate document reminders and ensure timely submission for faster loan processing. Document and data management systems are always an audit point for regulators, so it’s essential to implement a robust system.

Origination & Servicing Functionality

I recommend a CRM that offers integrated origination and servicing features to streamline loan processing and management. Look for automation capabilities that improve decision-making, credit risk management, and scalability.

Considerations for Small vs. Large Companies

As someone exploring CRM options, I’ve learned that the needs of businesses vary based on their size. Let’s break down what’s important for both small and large companies when choosing a CRM.

Small Companies

For startups and small businesses, scalability, customization options, and affordability are key considerations when selecting a CRM. As a small company ourselves, we understand the importance of choosing a CRM that grows with us in an affordable manner.

Scalability

We need a CRM that can handle our growing customer base without needing expensive upgrades.

Customization

A CRM must be adaptable to fit our unique way of doing things.

Affordability

Price matters. We need a CRM that’s powerful but still offers great value for money.

Large Companies

Conversely, for established players with larger teams and extensive operations, the considerations shift towards advanced features, scalability without compromising performance, and seamless integration with existing systems.

Advanced Features

Larger companies need a CRM with smart tools like AI and predictive analytics to handle complex sales processes.

Scalability and Performance

As the company continues to grow, the CRM needs to keep up without getting sluggish.

Integration

The CRM needs to be compatible with our other systems so data flows smoothly across our organization.

Conclusion

The best mortgage CRM software offers invaluable benefits for businesses of all sizes. It streamlines processes, improves customer relationships, and drives growth. Whether you’re a small startup or a large enterprise, finding the right CRM that aligns with your needs and budget is key to maximizing its potential and unlocking long-term success.

FAQ

-

1) What’s the best CRM for mortgage brokers?The best CRM for mortgage loan officers varies based on individual needs. Options like BNTouch, Shape Software, Aidium, and Velocity are popular choices.

-

2) Do mortgage brokers use CRM?Yes, mortgage brokers commonly use CRM software to manage client interactions, track loans, and automate marketing.

-

3) What software do mortgage brokers use?Mortgage brokers often use specialized CRM solutions. These platforms cater to their unique needs with features like lead management and marketing automation.