Best CRM Software for Investment Bankers

In a Nutshell

By implementing the right software, banks can streamline managing customers and access to information. This improves the customer experience while helping investment firms generate personalized marketing campaigns. As a CRM manager, I have hands-on experience with several CRMs for investment bankers, and this article highlights my top picks.

Best CRM Software for Investment Bankers Shortlist

- Salesforce – Best startups and growing investment businesses

- Hubspot – Best for investment banking integrations

- Microsoft Dynamics – Best for investor customer relations

- DealCloud – Best for investment banking workflows

- 4Degrees – Best for investment relationship intelligence

- Monday – Best for syncing and tracking orders and emails

- Pipedrive – Best for investment pipeline management

- Zoho – Best for investment banking journey orchestration

- Creatio – Best for complete customer overview

- Freshsales – Best for improving investment banking sales

Why Investment Bankers Need CRM

Managing interactions between clients and your company is an effective way to strengthen relationships and attract more leads. For investment bankers, this involves dealing with complex financial transactions and data-rich sales reports. Implementing a CRM will allow teams to better manage these relationships throughout the deal cycle. Below are more reasons why a CRM is essential.

Effective Data Management

CRMs for investment bankers enable the organization of large amounts of client data. Everything from contact details to products or services will be stored in a single location for easy access. Consolidating client information allows employees to have a single view of individual customers. This helps you understand the unique needs and requirements of each client.

Valuable Insights

Generating reports is usually a challenge for large organizations in the banking sector due to the vast amounts of data. However, teams can compile multiple reports over a specified period with a banking CRM. This information will be crucial to group individuals based on demographics, behavioral patterns, and interests to optimize future strategies.

The 10 Best CRM Software Solutions for Investment Banking

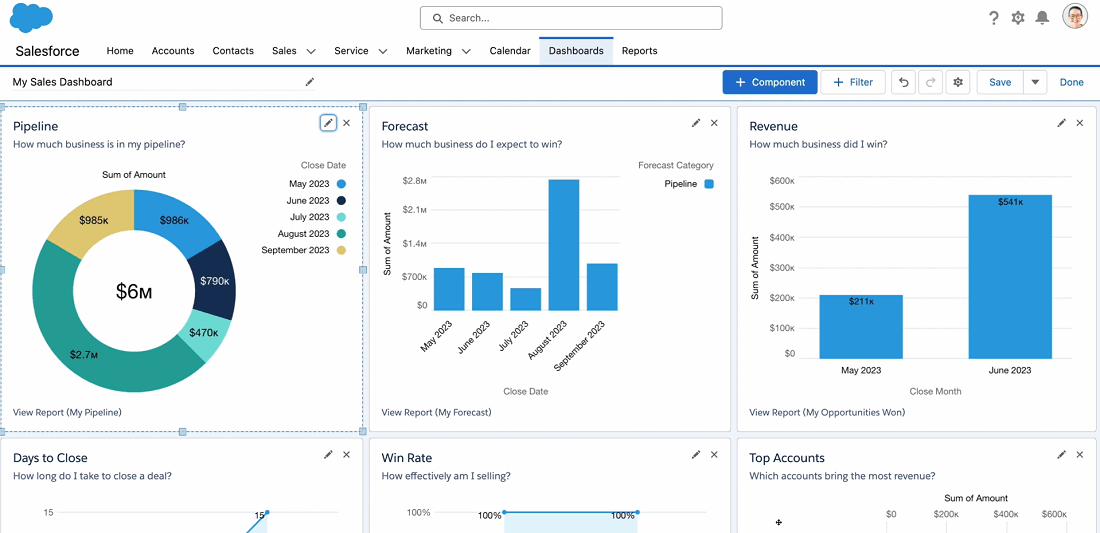

Salesforce offers a CRM solution specific to investment banking. The purpose-built system allows you to understand your clients better through insightful reports. Based on this information, your team will provide customized investment solutions and optimize deal pipelines.

Why I Like It

After using Salesforce as my main CRM, I can confidently recommend the software to any financial service. It improves efficiency by automating and reusing business processes across various channels.

Most Important Features for Investment Bankers

Salesforce has several features that can improve financial processes. These include cloud services for a similar experience across various channels, reporting tools with in-depth analytics, and pipeline management. Its AI-powered Einstein relationship insights also help you close deals faster.

Pros

- Accessible via a cloud service

- Easy to configure

- Supports multiple integration options

- Extensive customization options

Cons

- Less control over planned upgrades and downtimes

Hubspot is among the popular CRMs, with paid and accessible features to help financial institutions streamline marketing strategies. The scalable software includes a custom sales pipeline to fit client management needs.

Why I Like It

By combining services, Hubspot is an all-in-one marketing, sales, and customer service platform. I liked its features because it allowed teams to work cohesively on the same platform. It also simplifies business-to-consumer relations with no additional applications.

Most Important Features for Investment Bankers

Financial institutions will benefit from Hubspot’s contact management feature. This provides a detailed customer profile communication history and the current stage in the pipeline. Other features include task and activity management, email tracking, and analytics.

Pros

- Access to generative AI tools

- Scalable for growing institutions

- Streamlined internal communication

- Detailed analysis and reporting tools

Cons

- Pricing might be too expensive for small businesses

- There is no community support for the free tier

Microsoft Dynamics 365 offers a comprehensive solution for investment bankers and other businesses. Its ability to analyze and integrate complex data from various sources allows for the breakdown of details and alignment of processes.

Why I Like It

If you work with customer-facing teams, try this Microsoft tool. The product ensures you meet the ever-changing customer demands in the fast-paced financial world. Key features that impressed me include intelligent customer insights and process automation.

Most Important Features for Investment Bankers

Microsoft Dynamics 365 has all the features you’d expect in CRM. These include customer data management, automation, and customer service management. It also allows integration with other applications and mobile access for on-the-go access.

Pros

- Easy migration and implementation

- Plenty of customization options

- Integration options for collaboration

- A complete end-to-end platform

Cons

- New users must learn the basics

- Pricing might be too high for startups

Intapp DeakCloud offers a single platform to help financial teams build stronger relationships and accelerate lead acquisition and conversion. It also gives teams all the tools, including Applied AI, to execute their tasks quickly and efficiently.

Why I Like It

I was impressed by DealCloud’s dashboards because they allowed investment banks to manage their sales pipeline systematically. Team leaders and CEOs can also track everything happening with a single click of a button.

Most Important Features for Investment Bankers

DealCloud’s pipeline management capabilities let investment bankers configure workflows, reports, and unique tasks for team members. The tool also provides detailed analytics for decision-making and the ability to execute promotional email campaigns.

Pros

- Designed for financial transactions with specific workflows

- End-to-end deal management

- Flexibility and customization options

- Supports multiple integrations

Cons

- Advanced features come with a higher price tag

4Degrees CRM was created to support the requirements of private markets and other professionals in the financial industry. The system lets you capture the data of potential leads and leverage the relationship to increase conversion.

Why I Like It

In my list of the best CRM for investment bankers, 4Degrees is software designed specifically for investors. I liked the tool because it gave users all the freedom and featured an intelligent reminder to prevent key relationships from going stale.

Most Important Features for Investment Bankers

Relationship intelligence is one of the key and most valuable features of 4Degrees CRM. It allows your company to build stronger relationships by notifying you of any changes. This could be when connections switch jobs, publish content, or make the news.

Pros

- Centralized client data for a holistic view

- Pipeline management for deal monitoring

- Streamlined workflows with collaboration features

Cons

- A learning curve for new users

Monday.com CRM is designed to help financial teams track and manage customer data throughout sales cycles. It offers automation tools for repetitive manual work, reliable customer support, email composition and rephrasing, and formula building.

Why I Like It

Monday.com includes intuitive features for teams that need a high degree of customization. I liked how they have webinars, a knowledge base, and 24-hour customer support to help you every step of the way.

Most Important Features for Investment Bankers

Starting with email synch and tracking, Monday.com lets you stay on top of each interaction. It can be connected to Gmail and Outlook, and the messages are automatically logged. Other features include email composition, Activity management, and mass emails.

Pros

- Intuitive and modern dashboard

- Highly customizable

- Integrates with other third-party apps

- Excellent customer support

Cons

- A minimum team size of three is required for paid plans

Sales reps in investment banks will find the capabilities of Pipedrive CRM helpful. The software packs several features to help in marketing and create a result-oriented pipeline. Although it does not offer a free plan, available options are affordable.

Why I Like It

After testing this CRM, I was impressed by its user interface, which was easy to navigate. Entire sales processes were also broken down into steps. With this information, you will track leads as they go through your sales funnel.

Most Important Features for Investment Bankers

Pipedrive’s core functionality is visualizing financial processes for better decision-making. The representation includes current deals, win probabilities and the value they bring to the company. Other features include automation, reporting, and communication tracking.

Pros

- Several options for customizable sales pipelines

- User-friendly interface

- Allows access to APIs for complete customization

- Workflow automation is available for most plans

Cons

- No free plan

Thanks to its flexible CRM software, investment bankers looking to expand should choose Zoho. Its dedicated migration program and various customization options ensure less costly training and deployment. Financial sales teams are also empowered with robust workflow automation and personalized solutions.

Why I Like It

Zoho CRM has been in the market for over 15 years, working with numerous businesses around the globe. This tool is one of my go-to options for managing leads and clients from a single location. It has a quick onboarding process for an institution of any size and 24/7 customer support.

Most Important Features for Investment Bankers

One of the key features of Zoho CRM is journey orchestration using the CommandCentre. This feature visualizes pipeline maps to help you create result-oriented journeys. Other features include remote work, predictive analysis with Zia AI, and analytics.

Pros

- Free plan available

- Mobile app

- Affordable pricing tiers

- Supports multiple integrations

Cons

- The free plan does not include integrations and AI

Creatio is an all-in-one platform for automating end-to-end customer journeys. Its no-code approach allows investment bankers’ sales teams maximum freedom and customization. The ready-to-use platform supports automated lead management and campaigns.

Why I Like It

The Creatio CRM is an all-encompassing solution for relationship management and business applications. While testing this tool, I identified extensive functionalities to maximize team collaboration and increase campaign efficiency.

Most Important Features for Investment Bankers

Customer 360 is among the most valuable features of Creatio. It gives you a complete view of the customer with a history of engagement on all channels. As an omnichannel platform, it also enables cross-team collaboration to increase the efficiency of campaigns.

Pros

- Advanced email marketing tools

- Automated lead follow-ups

- Customization options with workflow templates

- Adaptable and scalable

Cons

- Learning curve for new and non-technical users

Freshsales CRM is specifically designed for the financial sales teams to create and run innovative campaigns to attract more leads. The software uses Freddy AI to identify unique requirements for each customer, resulting in better engagement.

Why I Like It

As AI grows, it has become part of everything we do, even in the banking sector. Freddy Ai was one of my favorite features while testing this CRM tool. It tracks entire processes while helping you build effective campaigns.

Most Important Features for Investment Bankers

Freshsales has several features to assist investment bankers in carrying out their duties to perfection. Its compatibility with mobile devices ensures your team can interact with leads using various channels from any location. The deal management feature also tracks financial processes to build a record.

Pros

- Various automation options

- Reliable customer support

- Customizable sales report and dashboard

- Contact lead via chat, email, and phone calls

Cons

- Most features are dedicated to sales teams

Considerations for Small vs. Large Investment Banks

Choosing the right CRM software is a crucial step for investment bankers. Whether you are running a small firm or a big financial company, its benefits outweigh the costs. But, it is essential to note that the requirements for each vary widely. Below are two considerations for small and large investment banks.

Integration

The ability to connect with other apps ensures seamless information sharing. This means essential integrations like email, calendar, and market research tools for small investment banks. Larger institutions require broader integrations and scalable ecosystems to manage complex operations.

Customization

Combining your business process with a CRM can significantly affect your investment bank’s operations. Startups should focus on CRMs that will attune to distinct financial processes. Multiple departments in larger institutions call for more extensive customization options.

Pricing

Small investment banks should focus on a cost-effective option that balances affordability with features. Well-established financial institutions must prioritize scalability and functionality over the initial cost.

Security and Compliance

Financial CRMs store sensitive client details, hence the need for security, privacy, and compliance with the law. The best software will have secure, robust systems and open-source solutions to give you unprecedented freedom. Some functions and features that make this possible include:

Access Controls

Each individual in an organization performs specific roles that contribute to the company’s overall success. Depending on a person’s task, role-based access control limits what applications, data, and even entire networks one can access.

Multifactor Authentication

As we have seen in recent attacks, passwords are not the strongest alone. When choosing a CRM, find one that supports multi-factor authentication, such as a one-time security token. This simple technology adds an extra layer of protection against phishing.

Data Loss Prevention

Given the amount of data bankers handle, there is always a chance of breaches and data leaks. The right CRM will add a data loss prevention functionality to detect these possible violations.

Encryption Key Management

Each individual in a banking CRM has a unique encryption key to access client information. If the vendor stores these keys, any attack on them might put customer data at risk. It is essential that you that financial institutions manage these keys locally.

Conclusion

After exploring the top CRMs for investment bankers in 2024, it is clear that the right software will enhance your operational efficiency. Detailed insights into leads help you streamline processes and tailor your interactions to clients’ needs. The tools listed have undergone rigorous evaluations to help you achieve your goals. Ensure to test them before choosing one that fits your institution.