Best CRM Software for Private Equity

In A Nutshell

As a seasoned tech reviewer, I’ve spent countless hours evaluating the latest CRM software solutions for private equity. With every passing year, customer relationship management is needed in private equity, so the software has to keep up. In this review, I’ll delve into the best private equity CRMs and their features to explore.

Best CRM For Private Equity 2024

To make it in private equity, having high-functioning CRM software is essential. While organizational preferences may differ, I have found the following to be worthwhile options:

- Salesforce – Best private equity CRM overall

- DealCloud – Best for module linking

- Dynamo – Best private equity CRM for limited partners

- SatuitCRM – The most user-friendly CRM platform

- 4Degrees – Best CRM for private equity firms for multi platform integration

- Altvia – Best alternative private equity CRM

- Zoho – Best AI-powered private equity CRM

- Affinity – Best CRM for relationship management

- Insightly – The most secure private equity CRM

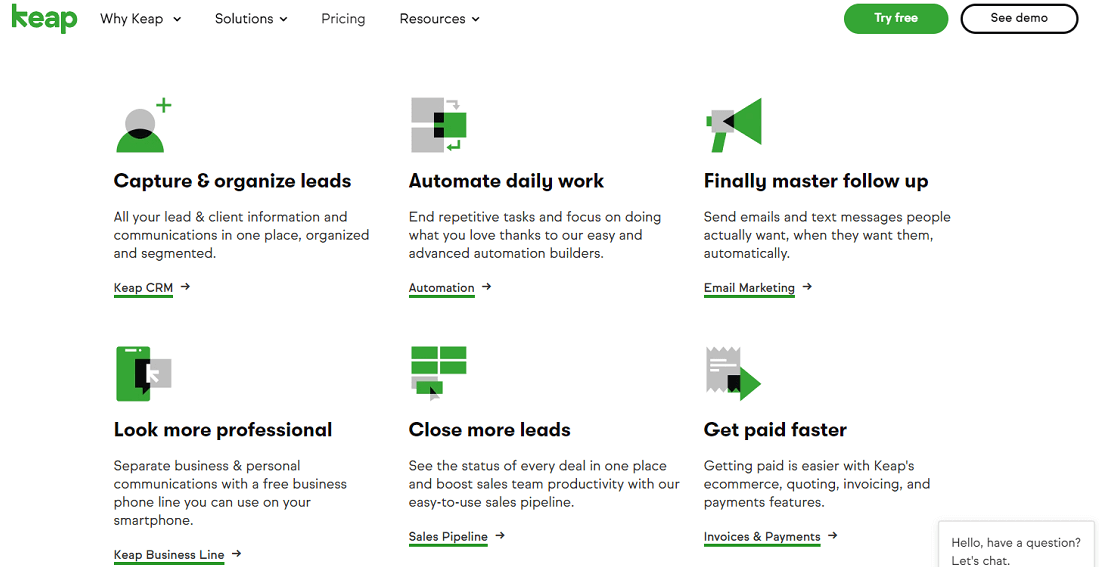

- Keap – Best CRM for campaign automation

Why Private Equity Firms Need Good CRM Software

Intense competition is the name of the game in private equity, so you need efficient tools to help you compete. I’ve learned that effective CRM Software can boost the quest to adapt to market trends and achieve operational efficiency. A combined use of market-centered features to make informed decisions is crucial.

The key feature portfolio managers get from the best private equity CRM is relationship management. Users can easily cultivate and nurture strong investor relationships through CRM solutions, like deal sourcing. A centralized investment management CRM hub consolidates critical data, enhancing collaboration and streamlining deal pipelines.

In addition, private equity professionals benefit from well-analyzed data, which is handy in risk management. The data also helps in regulatory compliance, reducing the need for manual compliance and hence increasing productivity.

A well-designed CRM also provides actionable insights crucial in streamlining the onboarding process for new clients and partners. This consolidated data ensures smooth transitions and seamless process flow in private equity firms.

The Top 10 Best CRM Software Solutions For Private Equity Firms

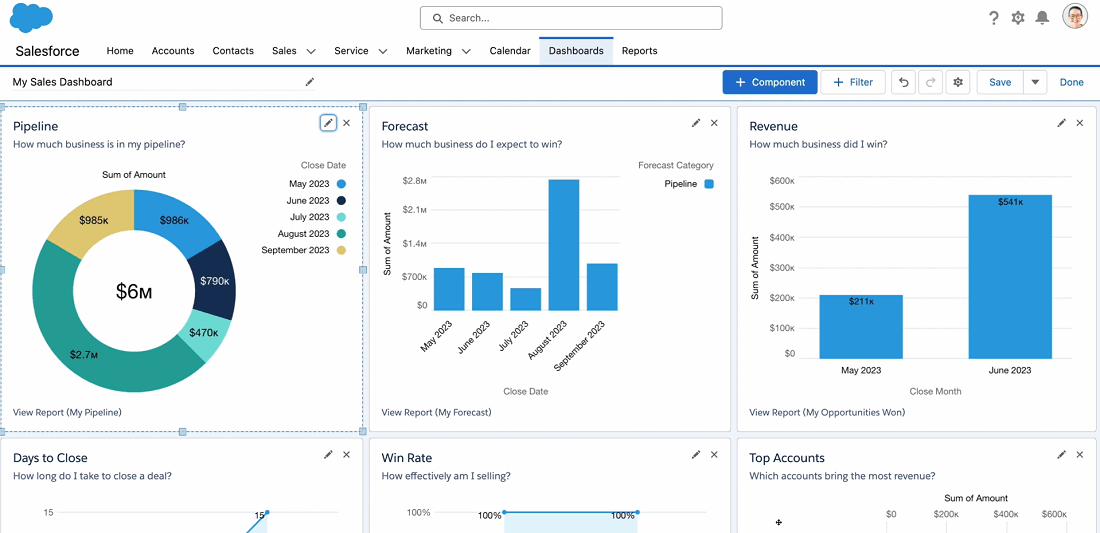

Salesforce utilizes advanced AI capabilities that empower private equity firms to unlock data and personalize client engagement. In return, it drives growth through modernized experiences and real-time financial insights.

Why I Like It

Salesforce for private equity firms offers a unified view of clients, enabling advisors and sales teams to quickly access insights and recommendations. This ultimately enhances client service and satisfaction. The platform’s AI capabilities and automation features boost advisor productivity, allowing private equity firms to focus on building strong relationships and growing their assets under management (AUM).

The Most Important Private Equity Features

- Investor communication tracking and management through a unified CRM platform.

- Data-driven insights for personalized advice and strengthened relationships.

- Integration with financial software for seamless data flow and analysis.

- Customizable dashboards and reporting for comprehensive performance tracking.

- Scalable client service through self-serve options and AI-powered assistance.

Pros

- Easy lead tracking and pipeline management.

- Comprehensive and customizable reporting capabilities.

- Integrates well with other platforms, streamlining workflows.

- AI-powered insights and automation for enhanced productivity.

Cons

- Searching for specific cases can be time-consuming.

- Requires a significant commitment to fully utilize the platform’s features.

Why I Like It

In my experience DealCloud’s ability to link different modules sets it a bar higher in private equity CRM. This one-stop solution enables teams to efficiently handle investor relations and track deals. Connecting with third-party data providers is easier on DealCloud due to its multiple customization options.

Most Important Private Equity Features

- Investor communication tracking to manage and monitor interactions with key stakeholders.

- Fund management capabilities for efficient oversight of private equity funds.

- Deal sourcing and tracking features to identify and manage potential investment opportunities.

- Integration with financial software to ensure seamless data flow and analysis.

- Customizable dashboards for visualizing complex data and gaining actionable insights.

Pros

- A swift and responsive customer service team.

- Enables efficient collaboration among remote teams.

- Provides advanced analytics and data visualization for informed decision-making.

- Allows for data reuse across systems, minimizing manual actions.

Cons

- The email marketing platform (Dispatch) is reported to need more functionality.

- Customization efforts and change management can be time-consuming and complex.

Dynamo is a comprehensive, cloud-based solution for private equity professionals to maintain and strengthen investor relationships. It enables users to configure workflows to match their organizational needs.

Why I Like It

Among the private equity features in Dynamo is the engaging experience with limited partners. Users can access portfolio performance data and investment opportunities communication anywhere. It also uses an integrated approach for portfolio reporting, fund accounting, and capital raising. As such, it eliminates the need for multiple systems to increase efficiency.

Most Important Private Equity Features

- Investor communication tracking and management through a centralized CRM.

- Fund management capabilities for efficient oversight of private equity funds.

- Deal sourcing and tracking features to identify and manage potential investments.

- Integration with financial software for seamless data flow and analysis.

- Customizable reporting and analytics for data-driven decision-making.

Pros

- Integrates easily with Microsoft products.

- A highly flexible platform with many customization options.

- Impeccable reporting and analytics features for valuable insights.

- Responsive and helpful customer support team.

Cons

- Initial learning curve due to the complexity of the user interface.

- AI add-ins may sometimes relate entities incorrectly to activities.

- Challenges with managing a high volume of transfers within and across entities.

- Some users have found transfers across entities challenging.

This award-winning private equity CRM software is ideal for portfolio management, deal flows, fundraising, and more. SatuitCRM offers various asset management features for effective relationship management and business growth.

Why I Like It

When asked for an easy-to-use CRM with prominent capabilities in investment management, I readily recommend SatuitCRM. Its desktop and mobile versions make tracking and monitoring deal opportunities easy. You can also manage legal aspects in its dashboard and flawlessly leverage internal and external resources. All this happens in a user friendly platform with helpful customer service.

Most Important Private Equity Features:

- Can easily integrate Gmail and Outlook to manage incoming and outgoing capital calls.

- Ability to create fundraising pipelines that integrate third parties with a few clicks.

- Has mobile versions to keep you in the loop from anywhere.

- Investor communication tracking through relationship tracking and account alerts.

- Team assignment functionalities for efficient collaboration and task management.

Pros

- User-friendly and intuitive interface for easy data input and analysis.

- Saves time by centralizing data and eliminating redundant data entry.

- Generates valuable insights and intelligence from the CRM data.

- Responsive customer support team to address user queries and concerns.

Cons

- Occasional slowness when loading screens and retrieving data from the server.

- Lead management proficiency needs to catch up compared to competitors.

For portfolio managers looking to leverage integrations, 4Degrees is the best option. This platform works well with over 1,000 tools via Zapier to ensure your private equity firm operates smoothly.

Why I Like It

When you choose 4Degrees, you can also benefit from the relationship intelligence of other tools, such as Hubspot and Salesforce. This, alongside its ability to integrate other apps such as Dropbox, Chrome, and Gmail, makes it appealing. Deal management on this platform is also made easier by its ability to automatically populate the team’s relationship network. It provides relevant alerts and suggestions to help you stay connected with key contacts. Its customizable pipeline management and reporting features are also valuable for optimizing the investment processes.

Most Important Private Equity Features:

- Easy metrics visualization for Monday meetings.

- Relationship network detection and engagement.

- Pipeline management with customizable fields and automated data entry.

- Comprehensive reporting for understanding network strength and deal flow.

- Effortless outreach with recurring reminders.

Pros

- Automatically syncs with email and calendar to understand and add new contacts.

- Provides relationship alerts and suggestions based on relevant news and events.

- Enables customizable pipeline management and reporting.

- Offers integration options with other CRMs like Hubspot and Salesforce.

Cons

- Prepopulated tags may require manual adjustment for specific use cases.

- Visualization tools could be enhanced for more advanced insights.

Altvia’s AIM CRM, built on Salesforce, streamlines private equity workflows, enhancing data organization. Private equity professionals can utilize it to manage investor relations, deal management, and reporting for informed decision-making.

Why I Like It

Altvia’s AIM CRM is a game-changer for private equity firms looking for the convenience of Salesforce, but without the price tag. Their sales point of transforming data chaos into organized efficiency prioritizes smart engagement through proprietary interaction functionality. You can waltz through the capital raising process, fund assessment, and manage direct investment opportunities.

The CRM’s dynamic dashboards and visual storytelling capabilities help uncover opportunities and make informed decisions.

Most Important Private Equity Features

- Automatic capture of customer relationship interactions.

- Tracking detailed notes on calls, meetings, and emails.

- 360-degree visibility by connecting account and contact records to deals, funds, and investor records.

- Streamlined capital raising process with real-time tracking and reporting.

- Enhanced due diligence efficiency with tailored checklists.

Pros

- Easy integration into existing processes with excellent support from the Altvia team.

- Customizable to specific needs and integrates with other platforms.

- It has a responsive mobile app for easy access.

- Swift navigation and excellent data visualization.

Cons

- Salesforce’s capabilities ultimately constrain functionality.

- The learning curve often requires support staff assistance.

Like Salesforce, Zoho CRM is a well-acclaimed all-rounder CRM. I’ve encountered it in many fields, and it still works well in private equity. This feature-rich CRM platform has several AI powered features that boost its value as the best CRM for venture capital firms.

Why I Like It

Zoho CRM is an impressive platform for firms looking to enhance their output with AI tools such as DataPrep. I also enjoy the AI-powered Zia feature’s functionality that promptly responds to queries. You can also create custom functions easily using the Creator feature. This private equity CRM software also has omnichannel capabilities for effortless stakeholder interaction. I feel confident that Zoho would be the best crm for hedge funds, too.

Most Important Private Equity Features:

- Customizable modules, fields, and workflows to match the firm’s processes.

- AI-powered lead scoring and insights for targeted outreach and improved conversion rates.

- Omnichannel communication for efficient client and prospect engagement.

- Comprehensive data analytics and reporting for informed decision-making.

- Mobile app with essential features for remote and on-the-go access.

Pros

- Highly customizable interface and workflows.

- Extensive app marketplace for seamless integrations.

- Comprehensive basic tier with essential features.

- Mobile app with key functionalities for remote work.

Cons

- Limited brand recognition in the US market.

- Complex initial setup that requires a lot of training.

Affinity is a relationship intelligence CRM that empowers private equity firms to streamline deal flow, automate data entry, and leverage enriched insights for faster origination and improved pipeline management.

Why I Like It

Affinity is a game-changer for private equity firms looking to optimize their deal flow and relationship management. It combines the firm’s collective network and provides real-time relationship intelligence based on interactions. In addition, Affinity’s automated data entry and enrichment features save dealmakers countless hours. The platform’s research tools and filtering capabilities make sourcing the right deals a breeze.

Most Important Private Equity Features

- Firm-wide relationship intelligence for faster deal origination.

- Automated contact and company profiles with data enrichment.

- Improved deal flow and pipeline management with research tools and filtering.

- Seamless integration with Outlook for effortless data entry.

- Customizable lists and board views for easy visualization and prioritization.

Pros

- Seamless Outlook integration.

- Intuitive and user-friendly design.

- Easy data exporting for reporting and analysis.

- Significant time savings on manual data entry.

Cons

- Limited prompts for updating and sorting new connections.

- Sometimes, the platform is sluggish.

Insightly tops my list when recommending CRM solutions to budget-conscious venture capital firms. This modern software helps firms streamline activities and build lasting customer relationships with intuitive features.

Why I Like It

Insightly is the most secure private equity CRM I have encountered. It utilizes multi factor authentication to safeguard documents and has SOC 2 accreditation. Furthermore, the platform is swift in its operations, hence boosting productivity. With Insightly, you can streamline sales processes to improve profitability by utilizing its vast customization options.

Most Important Private Equity Features:

- Customizable workflows and pipelines to suit the unique needs of private equity firms.

- Powerful reporting and analytics for data-driven decision-making.

- Easy integration with other tools to enhance overall productivity.

- Secure data management with SOC 2 accreditation and multi-factor authentication.

Pros

- User-friendly interface and easy adoption.

- Highly customizable to meet specific requirements.

- Seamless integration with other tools.

- Responsive customer support.

Cons

- Email tracking smoothly may not work via mobile.

- Chrome extensions may not offer the best experience.

Keap makes marketing automation to streamline business processes a breeze for better customer experiences. It’s also effective in cycle automation and lead tracking.

Why I Like It

Whenever I have to manage a demanding campaign in the financial services industry, Keap comes to mind. This platform has helpful features that help you track investors, run fundraising rounds, and facilitate personalized communication. Nurturing leads with Keap’s functionalities and automating follow-up is effortless.

Most Important Private Equity Features:

- Advanced marketing automation capabilities for targeted campaigns.

- Comprehensive contact management and segmentation.

- Life cycle automation to ‘hello’ map out a growth framework.

- Robust reporting and analytics for data-driven decision-making.

Pros

- Effective tagging system for organizing contacts.

- Powerful campaign automation tools.

- Integration with third-party tools for enhanced personalization and conversion.

- Enhanced lead automation and user-friendly email broadcasts.

Cons

- Relatively expensive compared to some alternatives.

- The learning curve may be steep for some users.

Conclusion

Choosing the right private equity CRM is a critical decision that affects your organization’s efficiency. Most processes must go through your selected software, so you must have a solid understanding of your needs and available solutions to make an informed decision. Thankfully, my top ten recommendations will help you narrow your choices.

FAQs

-

1) What is CRM in private equity?CRM software helps manage interactions with investors, portfolio companies, and potential acquisitions in private equity. It streamlines fundraising, monitors portfolio performance, identifies investment opportunities, facilitates collaboration, and provides data-driven insights.

-

2) What is CRM in venture capital?For venture capital firms, CRM systems help manage relationships with startups and entrepreneurs. They track deal flow, monitor portfolio performance, identify new opportunities, facilitate collaboration, and manage relationships with co-investors and advisors. CRM also provides reporting and analytics to support data-driven decision-making.