Insureio CRM Review 2025 | Overview of Features & Pricing

My Verdict

- Perfect for Insurance Companies

- Policy Management

- Tailored CRM

- Broad Functionality

- Automation

- Marketing Capabilities

- Insightful Reporting

- Limited features

- Learning Curve

- Pricey

- Customization Constraints

Pricing

Basic

Marketing

Agency

Marketing & Agency

Integrations

What Does Insureio CRM Do?

Insureio CRM is a specialized Customer Relationship Management (CRM) solution designed by and for life insurance producers. It caters to the insurance industry’s unique needs, providing a comprehensive suite of tools for contact management, application fulfillment, case management, sales tools, marketing, communications, agency management, and lead management.

Insureio’s focus on the insurance sector differentiates it from other CRM solutions. It’s not just a generic CRM repurposed for insurance; it’s built from the ground up with the specific needs of insurance professionals.

As we delve deeper into this review, we’ll explore how these features make Insureio a standout choice for insurance professionals looking to optimize their sales processes and enhance overall efficiency.

Key Features of Insureio CRM

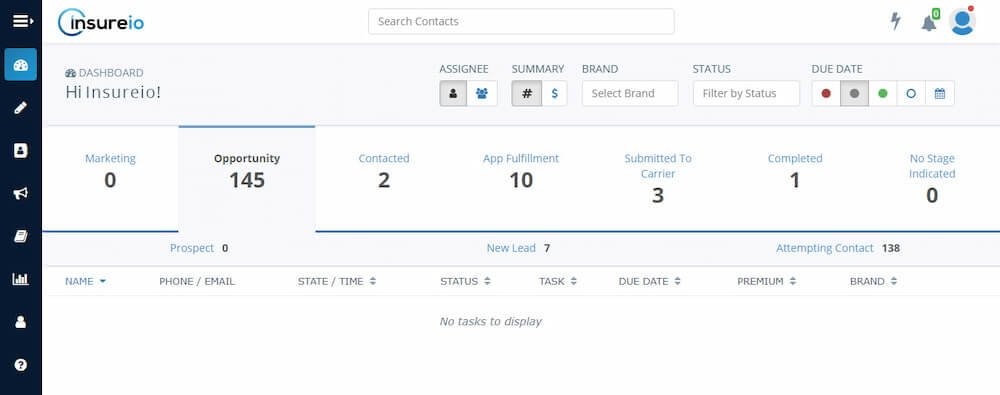

Insureio CRM is a comprehensive platform offering features designed to streamline insurance marketing and lead management. It provides a systematized, automated approach to selling, resulting in more sales, less paperwork, and happier clients.

Lead Management

Insureio excels in lead management, offering a feature-packed solution that makes it easier than ever to nurture insurance leads. It allows you to manage leads at every funnel step with an omnichannel consumer relationship management platform.

Key features include:

- Automated lead-to-sale conversion campaign follow-ups: Optimizes the sales cycle by creating automatic opportunities for up-sell, cross-sell, and referrals.

- Automated lead workflow management: Helps prospects through the buyer’s journey by building your workflow with custom status types and rules that trigger computerized emails, call reminders, and more.

- Lead routing and assignment: This feature sets up routing rules that automatically assign leads to you or a team member based on brand, referrer, or source.

Application Fulfillment

Insureio CRM also efficiently handles application fulfillment processes. It simplifies insurance using an easy one-page app for term life, permanent life, LTC, disability, and annuities.

Key features include:

- E-Ticket/drop ticket application fulfillment: Choose from two service levels – let Insureio’s distribution partners handle all the paperwork or process your completed apps.

- Electronic application and e-signature forms: This feature speeds up the process with e-policy processing and delivery.

- E-Policy Delivery: Save time and money when Insureio’s distribution partners deliver your clients’ policies electronically.

Pricing Plan

Insureio CRM offers a flexible and scalable pricing structure that caters to different types of users. The pricing is based on user licenses and is billed monthly.

Basic Plan

The Basic Plan costs $25 per month. It includes an e-application/Drop-Ticket Solution, unlimited quoting and lead capture widgets, unlimited brand profiles, and customizable analytics and reporting.

Marketing Plan

The Marketing Plan is $50 per month and includes everything in the Basic Plan: a personalized e-marketing website, pre-built marketing campaigns, and blast email distribution.

Agency Management Plan

The Agency Management Plan also costs $50 per month. It includes everything in the Basic Plan, plus lead routing and assignment, team view on the dashboard, and agent recruiting and marketing.

Marketing & Agency Management Plan

The Marketing & Agency Management Plan combines the features of both plans for $75 per month.

Insureio also plans to offer add-on features like Bulk Email and Team View. Insureio occasionally offers a free 30-day trial, allowing users to test the platform before committing to a subscription. This makes it a cost-effective solution for insurance professionals seeking a specialized CRM.

Is Insureio CRM Easy to Use?

In 2024, Insureio CRM continues to be recognized for its user-friendly interface and overall positive user experience. The platform is designed to focus on usability, making it easy for insurance professionals to navigate and utilize its extensive features.

Insureio provides a wealth of training resources to help users get the most out of the platform. Every new subscriber is automatically enrolled in a video tutorial course, which includes 11 lessons delivered via email. These lessons cover the basics of setup, navigation, running a quote, and more.

Insureio offers an on-demand webinar covering the basics and an overview of the agency management and marketing sections. Users can also request an online training session where an Insureio expert will show them how to navigate the platform, set up email, run a quote, submit a case, view case status, and more.

The platform provides comprehensive documentation, including contextual tutorial videos housed within the system. This allows users to learn at their own pace and refer back to the documentation whenever needed.

The onboarding process for new users is also well-structured. Insureio offers concierge-level service and unlimited access to personalized support via phone, email, or LiveChat. They also assist with data import, branding setup, and SMTP configuration.

Available integrations

Insureio CRM integrates with a variety of platforms to enhance its functionality. Here are some of the integrations:

- Carrier Systems: Over 30 carrier systems are integrated with Insureio.

- Email Platforms

- VoIP / Phone Clients: Insureio’s click-to-call feature integrates with your VOIP or phone client.

- SMS Platforms

Insureio Customer Service

Insureio CRM is known for its best-in-class customer support, available at all subscription levels. The support team is composed of in-house licensed agents who use Insureio to sell insurance daily.

You can reach the Insureio support team through various channels:

- Phone

- LiveChat

Insureio also offers a wealth of self-help resources, including an extensive Wiki, contextual help videos embedded within the system, and a FAQ page for quick answers.

Which Companies Work With Insureio CRM?

Insureio is popular in the insurance industry, offering every aspect of business all in one place. It ranks high on valuable review sites and shows testimonials from:

- AMG

- Taber Brokerage

- Pinney Insurance

- EBI

- Huntley Wealth

- Wholesale Insurance.net

Suitability Assessment

Choose Insureio CRM if:

- You’re an insurance professional or agency looking for a specialized CRM solution.

- It would help if you had a comprehensive suite of tools for managing leads, optimizing sales processes, and enhancing overall efficiency in insurance-related workflows.

- You value having a user-friendly interface with a wealth of training resources and excellent customer support.

- You’re looking for a CRM with a flexible and scalable pricing structure that caters to different types of users.

Avoid Insureio CRM if:

- You are not in the insurance industry. Insureio is a specialized CRM for insurance professionals, and while it’s excellent in that niche, it may not be the best fit for other sectors.

- You are looking for a free or very low-cost CRM. While Insureio offers much value, it may not fit into very tight budgets.

- It would help if you had a CRM with specific integrations that Insureio does not offer. While Insureio offers some integrations, it may not cover all the tools your business uses.

- You prefer a CRM with a more traditional or familiar layout. While many find Insureio’s interface user-friendly, it might not be everyone’s preference.

Please note that these are general guidelines, and the suitability of Insureio CRM can vary depending on your business’s specific needs and circumstances. It’s always a good idea to take advantage of any free trials or demos offered.